Discover First Home Fund in Scotland

Exclusively available in Scotland, the First Home Fund* means you may only need a 5% deposit to buy your first home, helping more first time buyers make their first home purchase. The scheme is now open for applications in 2021 until the end of March 2022.

The First Home Fund is available now until March 2022. If you are looking to move in 2021 or early next year, you can reserve a new home now, subject to your application being approved.

If you're a first time buyer and you want to stop saving and get on the property ladder, the First Home Fund could be the answer.

*subject to lenders’ criteria

Book your visit today.

What you need to know

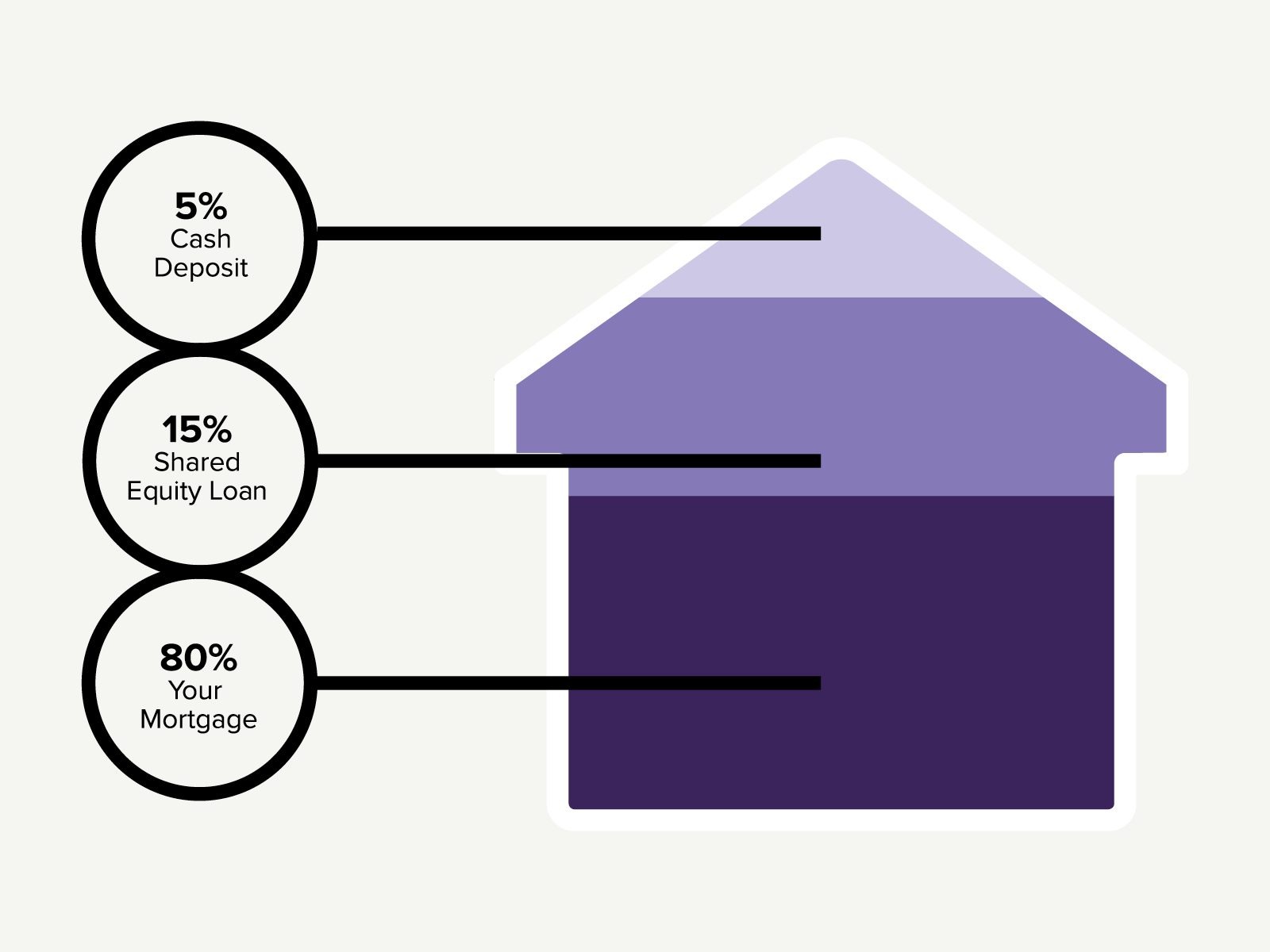

- Only a 5% deposit required

- Get on the property ladder sooner than you thought

- Interest free equity loan

- Available to first-time buyers

- Own 100% of your home

- The Government will lend you up to 15% of the value of the new property

How to qualify

To be eligible for the scheme, a buyer must take out a first charge mortgage with a lending institution.

This mortgage must be a repayment mortgage of at least 25%. If it's an interest-only first mortgage, the buyer won't be eligible for the scheme.

A mortgage lender is likely to require a deposit of around 5%. The mortgage and deposit must cover a combined minimum 85% of the total purchase price.

All applicants will need to submit payslips for the last 3 months along with a copy of their application form.

The level of mortgage offered by lenders will depend on expenditure as well as income, but it is generally expected that single buyers can borrow 4.5 times their household income and couples can borrow 3.5 times their joint income.

Affordability calculator

How much will your new mortgage cost per month?

Fill in the calculator to show you the monthly costs and total mortgage cost for your new mortgage.

The mortgage calculations are for illustrative purposes only. If using help to buy, make sure to include your own deposit plus the help to buy contribution.

Calculate monthly mortgage costs

Help to buy?

YOUR NEW HOME

COULD BE A CLICK AWAY

Let's chat about your dream home.

Let our expert team guide you through the process.